Contents:

Even with a well-designed hedge, it’s possible for both sides to generate a loss. Factors such as commissions and swaps should also be carefully considered. You may lack the expertise to leverage hedging to your own financial gain.

By using two different currency pairs that have either a positive correlation or negative relationship you can establish a hedge position. Options hedging is another type of hedging strategy that helps protect your trading portfolio, especially the equity portfolio. You can apply this hedging strategy by selling put options and buying call options and vice-versa. The hedging strategies work the same way as a stop loss order in terms of limiting losses. However, the advantage of hedging is that you can also make money on the hedge trade if you carefully select the second trade. Hedging in the forex market is the process of protecting a position in a currency pair from the risk of losses.

What is Swing Trading? The Best Strategies, Indicators and Signals to Trade for Beginners

If stocks are in a meltdown, the returns realized by cryptocurrencies could offset the loss in the equities market. Hedging can also have several strategic benefits for companies. The strategy can help companies lock in profits for the goods they produce. warren buffett blasted bitcoin as a worthless delusion and ‘rat poison squared For instance, commodity producers use the futures market to hedge open positions and lock profits by agreeing to fixed prices for future production. In this way, they are insulated from any potential drop in prices for the underlying products.

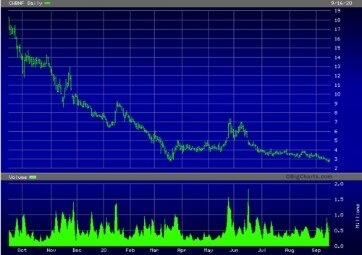

PrimeXBT Retrospective: Why Traders Short Bitcoin – Cryptonews

PrimeXBT Retrospective: Why Traders Short Bitcoin.

Posted: Thu, 09 Mar 2023 15:04:00 GMT [source]

Hedging strategy in the Forex market is one of the most popular tools to limit exposure to different kinds of trading risks and help you not lose money. With the right application, this method allows Forex traders to reduce the high risks with a minimum loss in profits. However, the only drawback of this method in Forex is at least a two-fold increase in the cost of opening a position. Let’s say an oil company’s trading plan is to buy $5,000,000 worth of kerosene in a month while its main capital is stored in euros.

What is the purpose of hedging?

The price action is not only dependent on purely technical indicators, but sometimes it is also influenced by fundamental elements as well. It might be disappointing to them, but unfortunately for those market participants, there is no such thing as a no loss trading strategy in Forex. There are several methods, which are aimed at reducing the number of losing trades and improving the chances of success. Having some of your money in cash can be an effective hedging strategy because you are not exposed to any investment risks. This strategy can be advantageous during downturn periods when most investments lose value.

Pairs trading can also help to diversify your trading portfolio, due to the multitude of financial instruments that show a positive correlation. Another element of the hedging strategy, which is already actively used by institutional investors to make money, is Carry trades. A carry trade is a low-interest loan in one currency pair and opening deposits with higher yields in another. There are also such financial derivatives as futures and options, whose primary role is hedging. However, these complex instruments are now more popular for speculators in active trading.

What Is the Volcker Rule, and How Does It Work? – Nasdaq

What Is the Volcker Rule, and How Does It Work?.

Posted: Wed, 15 Mar 2023 20:35:00 GMT [source]

There are many cases when usually correlated currencies and commodities diverge from each other because of the latest economic announcements or other factors. This is the risk of an investment decreasing in value because of events or developments that impact the entire market. Common market risks include currency risk, interest rate risk, as well as open position risk. The idea of hedging is more about mitigating risks and reducing losses, rather than generating profits. Hedging could be costly, as it requires additional capital to place hedging trades. Imagine you hold positions on shares in a range of international companies.

There are foreign exchange and over-the-counter types of hedging complex instruments. Forex pairs hedge trades are entered, as the definition implies, on the foreign exchange with the participation of a counterparty, which, in the case of Forex options, is the brokerage company. Over the counter hedge positions can not be opened on an asset exchange.

Trade fractional shares with no commission

First of all, successful implementation of any hedging strategy requires solid experience in Forex trading. Novice traders may find hedging a bit overwhelming and if the strategy is not carried out properly it may lead to more losses rather than help reduce them. Therefore, it is recommended that beginners practice hedging on a demo account first and when they feel confident enough – start using such a strategy on a live trading account. In a typical trading strategy, stop-losses are used to limit losses if the trade doesn’t go as planned. It allows a trader to keep their current position without closing the the trade. You probably have heard that in times of distress investors are buying puts to protected profits and hedge risk in case of a selloff.

Each trading terminal has an automated take profit function, but it also has a stop loss. A stop-loss is an offset currency risk order that gets you out of a trade if there are any adverse price movements against you by an amount you specify. Beginners do not like using a stop loss as they hope to gain back the loss. However, the subsequent downward reversal made the trader reconsider the initial forecast. Instead of closing a long position with a small profit, he minimizes the risk of the price going down further trade with a short position at the closing of the second downward bar . The main reason for such prohibitions is considered to be double trade costs with an insignificant trading result.

Insiders’ Hot Stocks

If you fear a stock market crash is coming or you just want to protect one of your trades from the market uncertainty you can use one of the many types of hedging strategies to gain peace of mind. Forex options trading allows currency traders to realize gains or hedge positions of trading without having to purchase the underlying currency pair. Full BioJohn Jagerson has more than 15 years of experience in stocks, options, Forex, bonds, and portfolio analysis. He is an expert on corporate finance and accounting, market news, and stocks. John earned his bachelor’s degree in accounting and business management at Utah Valley University.

- This method worked well for 7 years and many market participants have earned some decent payouts by using this strategy.

- Hedging with forex is a strategy that traders use to protect their positions from the potential loss in Forex trading.

- For instance, you must understand different markets, such as options and futures, to successfully hedge against risks in the equities market.

Hedging is a risk management tool that is essentially used to protect capital by offsetting losses by taking opposite positions in the same currency pair or a related asset like a forex CFD. Capital is protected against related security price changes, extreme forex movements, exchange rates, inflation, etc. Our online trading platform, Next Generation, makes currency hedging a simple process. Our platform contains 330+ forex pairs that are available for long or short positions to suit every trader. The purpose of a cross currency swap is to hedge the risk of inflated interest rates. The two parties can agree at the start of the contract whether they would like to impose a fixed interest rate on the notional amount in order not to incur losses from market drops.

In other words, if you bought 1 lot of EUR/USD, you would throw a 1 lot sell EUR/USD to offset the first trade. If the vote comes and goes, and the GBP/USD doesn’t move higher, the trader can hold onto the short GBP/USD trade, making profits the lower it goes. The costs for the short-term hedge equal the premium paid for the call option contract, which is lost if GBP/USD stays above the strike and call expires. Here you sell the available currency pair at a specific time and you will get healthy profits with the help of these trend lines. In this second strategy of forex strategy the forex trader can create a hedge and protects the current move from an unexpected movement result.

Cross currency swap hedges are particularly useful for global corporations or institutional investors with large volumes of foreign currency to exchange. A UK-based brewery that has expanded into the US market may take an order for $100,000 worth of its product from a US-based buyer. If the exchange rate at the time the sale is agreed is 0.745 USD/GBP this is equal to £74,500. The company may agree to the sale and send the goods to the buyer, expecting to receive $100,000 from the buyer which will convert into £74,500 of their domestic currency. You need to be comfortable with timing trades and market swings.

They are not traded in the market and usually conducted once. Hedging is used to secure trading positions against possible adverse changes in market conditions and the risk of loss. Hedging is opening a position on the same trading instrument but in the opposite direction (e.g. for each buy order there should be a corresponding sell order).

Therefore, there is a risk that losses in one position will exceed rewards in another. Although forex hedging is typically used to limit risk for traders, poor execution of this strategy can be disastrous for your trading account. Traders often use hedges to protect against the short-term volatility https://day-trading.info/ of economic news releases or market gaps over weekends. Traders should keep in mind that as hedging reduces trading risk, it also lowers potential profits. Trading with forex options also creates hedging opportunities that can be effective when utilized in specific circumstances.

It’s important to have an in-depth understanding of the Forex market and a strong trading strategy. Traders use hedging as a way to protect themselves against exchange rate fluctuations. While there is no guaranteed way to remove financial risk, a hedging strategy helps to manage your losses as much as possible. A partial hedging strategy could be applied in case you were almost 100% sure that the downtrend will resume soon. You could reduce the loss in case of a sideways trend by opening two opposite positions at the same time.

If the euro did fall against the dollar, your long position on GBP/USD would have taken a loss, but it would be mitigated by profit to your EUR/USD position. If the US dollar fell, your hedge would offset any loss to your short position. Though the net profit of a direct hedge is zero, you would keep your original position on the market ready for when the trend reverses. Forex hedging is the act of strategically opening additional positions to protect against adverse movements in the foreign exchange market.

0 Comment on this Article